Below the fold is the final part of the series on the CIS’s recent paper on the Australian and New Zealand economies. I decided to write the whole thing out as an integrated whole and it has now been posted on Australian Policy Online.

There’s been a fair bit of rewriting and sorting out, so if you’ve read the previous posts you might want to have a squiz at the whole essay, or just skip to the final section – sections VIII and IX – for part three.

Australia v New Zealand – Ideology to the rescue

I

Like barrackers watching the Wallabies play the All Blacks since each became pioneers of economic reform in the mid 1980s, Australians and New Zealanders have found something new to barrack for the fortunes of their respective economies.

Ideological as well as national pride is involved. New Zealand moved further and faster from the mid 1980s to the mid 1990s. Australias failure to measure up to New Zealands example became a right of centre talking point on both sides of the Tasman. But New Zealands poorer performance became progressively less easy to disguise with judicious selection from the basket of economic indicators. And though it continues to be offered, the excuse that Muldoon made more of a mess than Whitlam and Fraser is surely wearing thin. Muldoons reign ended 25 years ago.

As someone with an interest in the question, Ive never read anything that convinced me that the author had really got to the bottom of the mystery of why the two countries economic performance has been so starkly different given the broad similarity of their policy trajectories.

But some of those who were lecturing us then about the superiority of New Zealand reform still seem to be in lecture mode. But its the New Zealanders who are getting the lecture. In 2002 Roger Kerr gave voice to what has become a new orthodoxy amongst the economic reform advocates in New Zealand.

There has been more continuity in Australian policy. The political consensus for change has been stronger, and there has been limited backsliding despite changes of government . . . . Indeed, by contrast with New Zealands record of stop-start reform . . . Australia has adopted a remarkably consistent, coherent and credible strategy of economic reform over the last two decades.

This makes me wonder whether the stop start nature of the reform might have had something to do with the excesses of the early reform efforts in NZ and the excesses of its advocates. I may be wrong, and I’d be glad if someone set me straight with evidence to the contrary, but the evidence doesnt seem to have brought forth much soul searching from the champions of New Zealand reform about their own possible role in the ecology of stop-start reform.

Unfortunately the Centre for Independent Studies latest contribution to the debate doesnt take us very far. Authored by Phil Rennie Why is Australia So Much Richer than New Zealand? is a study in tendentiousness. It is unimaginative in the things it doesnt look at, blinkered in the things it looks at only to look away, and simply wilful in the way it proposes lessons from its study.

II

The paper moves from one putative explanation for the divergence in performance to another finding most explanations wanting. It offers what I call the body language of an explanation. As its author said in the op ed of the report

Trying to solve this mystery is a bit like trying to solve a murder-mystery. We need to round up the likely suspects, interrogate them and look for enough clues to satisfy the judge and jury.

But a careful read reveals something else. To continue the courtroom analogy, suspects are interrogated with very different levels of scepticism and diligence. Some leave the stand having answered barely any questions while others are dismissed just when their testimony starts to get interesting. And others get a dream run, having only to recite some favoured line to have their testimony accepted as unimpeachable.

And the study never really defines the period over which it focuses. One would imagine it was the reform period from the mid 1980s on. Of course there would be nothing wrong with occasional asides about more contemporaneous events. But facts that relate only to comparatively recent events in this period are treated as if they referred to the whole period.

III

The paper rules out Australias mineral boom as a major explanation. New Zealands terms of trade have improved by a similar amount and, being smaller, New Zealand is more trade exposed than Australia. In any event, the terms of trade improvements are not much more than half a decade old and so dont explain the much longer running underperformance of New Zealand.

Having quoted reputable research claiming that as much as 50% of the gap in economic performance between NZ and other OECD countries is due to its smallness of size and distance from major markets the paper concludes rather flippantly Over the last thirty years, New Zealand hasnt moved further away from the world, and Australia hasnt moved any closer.

IV

The major explanation the paper offers for New Zealands underperformance is Australias greater capital investment per worker.

The major explanation the paper offers for New Zealands underperformance is Australias greater capital investment per worker.

There seems little doubt that this is an important part of the explanation, though I doubt its the only one. The paper then considers if the problem is a lack of capital or a lack of opportunities to invest.

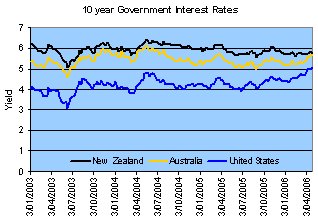

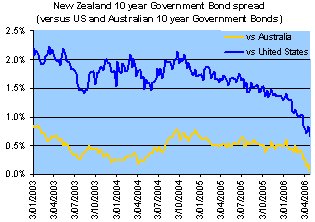

Lack of capital seems to turn up in the countrys accounts. The paper claims that New Zealands long-term real interest rates are similar to Australias but despite the inflation credibility of their Reserve Bank theyve been on average around fifty basis points higher over the last four years, not a small amount relative to the yield on ten year bonds of around 600 basis points. The differential at the time of writing was about half the differential over the period quoted.

Short term interest rates have been much higher in New Zealand. New Zealand has very little investment abroad (around 10% of GDP – which seems very low for such a small country). Australia had around that in the late 80s and has roughly tripled that figure. The capitalisation of Australia’s stock market has approximately doubled as a share of GDP since the early 90s in Australia while its remained stagnant in New Zealand. All this suggests a big difference in the amount of capital washing around.

Source: World Bank World Development Database available athttp://devdata.worldbank.org/query/default.htm

Source: World Bank World Development Database available athttp://devdata.worldbank.org/query/default.htm

Then there’s NZ’s savings rate and current account deficit – both of which look awful. Current account deficits record domestic investment outstripping domestic savings. Yet, despite substantially lower investment than Australia, current account deficits yawn even wider for New Zealand than they do for Australia and look like doing so for as long as we can reasonably foresee.

| Key indicators | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

| Real GDP growth (%) | 3.1 | 2.8 | 2.9 | 2.7 | 2.9 | 3.0 |

| Consumer price inflation (av; %) | 2.5 | 2.6 | 2.5 | 2.3 | 2.3 | 2.3 |

| Budget balance (% of GDP) | 4.8 | 4.5 | 4.6 | 4.7 | 4.8 | 4.9 |

| Current-account balance (% of GDP) | -8.1 | -7.5 | -7.1 | -6.8 | -7.0 | -7.2 |

| Short-term interest rate (av; %) | 12.7 | 12.7 | 12.2 | 11.8 | 11.6 | 11.6 |

| Exchange rate NZ$:US$ (av) | 1.37 | 1.41 | 1.50 | 1.60 | 1.67 | 1.77 |

| Exchange rate NZ$:¥100 (av) | 1.17 | 1.34 | 1.56 | 1.71 | 1.82 | 1.9 |

Source: The Economist

When considering the availability of capital the paper moves as it frequently does from a diagnostic mode to something in which immediate policy implications seem to loom larger undermining the pertinence of the analysis. The paper makes a reasonable point that a lack of access to capital seems strange when there is a glut of global savings. A fair point, but only one that applies to the last third of the period under study. From the mid 1980s to the late 1990s there wasn’t a savings glut, so if the availability of capital hypothesis doesn’t fit the most recent period (during which growth was better in NZ) mightnt it fit the earlier period? Unfortunately our investigator has no further questions for the witness.

Having dismissed the lack of funds explanation the paper proposes that the real culprit is lack of investment opportunities. But this argument seems awfully thin. The paper argues that investment has been scared off by NZs stop-start approach to reform. But this causal chain has several steps each of which calls for corroboration. Again New Zealand didnt have stop-start reform for at least the first half of the reform period. Australias reform also slowed down under the Howard Government. Indeed it was a tad stop start itself. There was little action from 1996 until mid 2000 at which time there was a major tax overhaul. Major reform went back into dormancy until the introduction of Workchoices well into the last three year term of the Howard Government.

And if stop start reform is the culprit, the thing that has scared away capital investment in New Zealand, thered be corroborating evidence – like investment and perhaps equity premiums changing at important times when reform stopped and/or started. The paper provides no such evidence.

The things that the paper cites as things that scared off capital have occurred recently so they cant explain New Zealands historical underperformance. They are also pretty tame in any event the kind of thing occurs in most countries not least Australia. Thus were told that the New Zealand government has issued instructions to its major telecommunications carrier. The same happened here. Air New Zealand, and Personal Injury insurance have been re-nationalised. Weve not renationalised anything much, but our state run workers’ compensation systems tend to go through similar cycles of policy intervention with both the regulatory regime governing workers’ compensation and its underwriting. In any event this is pretty small beer, the stuff of political decision-making in all democracies. John Howard left government notorious for the ubiquity, if not necessarily the magnitude of his pork barrelling. Likewise with reform was humming along nicely in the Hawke years there were any number of small compromises. Kodak got tossed $26 million to persuade it to keep operating. And so it goes.

V

The paper then heads into more controversial and more interesting waters, exploring the implications of Australias more rigid, unionised system of industrial relations. The paper suggests there might be a trade-off. By driving up labour costs labour market regulation gives businesses a greater incentive to invest in their workforce not least in labour saving capital equipment but also other productivity enhancing investment including investments in training the workers themselves.

Is this part of the secret of Australias success and confirmation of the school of thinking that holds that judiciously used labour market regulation generates benefits for both workers and economic prosperity more generally? The idea was probably the orthodoxy in economics a generation ago a shibboleth of the Keynesianism of the time. Lee Kwan Yew supported it in Singapore for a while, and it makes occasional somewhat surprising reappearances as for instance when the Australian Productivity Commission proposed that the margin pressure placed on businesses from tariff reductions led to a cold shower effect that caused them to smarten up their act.

On the other hand, even if you concede the marginal potential for this kind of win-win, if it is not practiced with great judiciousness, or perhaps with the very generous supplementary labour market programs we see in Nordic countries, labour market regulation is likely to price some labour out of the market.

What side are you on as this trade-off is made? Personally I give getting people on the fringes of the labour market a job a very high weighting. The paper deals with this tension by cashing some chips to score a quick ideological point and then moving on to other subjects. Thus after citing Australias higher unemployment rate, the conclusion is immediately drawn that clearly, many of its workers are being priced out of the labour market. It may be clear, but an alternative or supplementary explanation is that Australian welfare payments are higher.

Though it has just mooted the possibility that stronger labour market regulation might be responsible for higher investment in Australia, the paper goes on to assert without evidence that what seems to be relatively mild re-regulation of the labour market that has been implemented recently in New Zealand is depressing investment. However since the recent changes, judging from the chart of capital invested per hour worked capital intensity seems to have done just what its done in Australia risen.

VI

So what are the lessons from all this? The paper takes no interest in various things that occur to me as worthy of further thought. Here is a grab bag of ideas in no particular order, and the latter of which are not inspired by any existing policy differences between Australia and New Zealand.

New Zealands recent KiwiSaver scheme is to savings policy what Australias HECS was to funding university education a world first that will be adapted around the world. Compulsory superannuation would help lift New Zealands savings rate and so develop the pool of capital available to the most competitive New Zealand firms.

Removing tax distortions – NZ has no capital gains tax which I expect diverts domestic investment into fancy schemes to launder income as capital gain rather than in productivity enhancing investment. Its also notable that NZ property investors dont seem to have been scared off real estate investment despite the central bank ramping up short term interest rates to well above those of other countries. One would expect investors resilience to such punishment to have something to do with those tax free capital gains.

Given the current and likely future significance of public savings in New Zealands total savings effort, it should continue to innovate in building institutions to prevent politicians competing higher surpluses away.

Better incentives for innovation. The OECD recently observed that New Zealand should strengthen its support for research and innovation to boost economic growth.

Further, labour market diversity. I wonder if the diversity of Australias workforce may be generating better opportunities. As I understand it NZs population is less diverse.

I think our skilled migration program is more aggressive than New Zealands – certainly our ability to pay higher wages cant hurt in attracting better migrants! This point has a dynamic dimension to it. Once a country has a lead, it may be difficult for the other to claw its way back as it becomes harder and harder to retain or attract skilled labour.

Finally and in the same vein, I wonder whether NZ is suffering from some geographical problem in which its distance from the rest of the world has started to matter more. An analogy is what’s happening in regional Australia where small towns are dying but regional centres sucker cities are growing. Australia may have sufficient scale to attract its share of regional headquarters, retain at least most of its manufacturing, have a capital market that’s acquired critical mass. All this adds to its agglomeration economies. Perhaps NZ is just finding it progressively harder in these areas. If this is the case, I agree with the paper, that it is difficult to craft policy interventions to arrest the problem.

VII

Instead of discussing these issues, the paper has five policy suggestions which can be grouped under three themes.

The fourth and fifth suggestions are for better regulation. Suggestion four is for more light handed regulation. I have nothing against light handed regulation. As Ghandi said when asked what he thought of Western civilisation – I think it would be a good idea. But we need much more detail to make sense of the proposal. I dont think weve got more light handed regulation in Australia than New Zealand has. In fact given the way the complications of federation louse up regulation and the purity of some NZ regulatory and management regimes, I expect NZ has always been somewhat in front here, though no doubt it depends on what areas are examined.

Suggestion five is that the Regulatory Responsibility Bill be passed into law. This looks like a relatively harmless piece of red tape which cranks up requirements to justify regulation beyond existing requirements for regulatory impact statements. Since these kinds of requirements have been beefed up previously on numerous occasions in numerous countries with relatively little effect on regulatory excess (Ambler and Chittenden, 2007) this seems unlikely to offer any breakthroughs.

The third suggestion is that the quality of public spending should be improved an assertion with which one cannot argue. The issue is pursued in greater detail in another CIS paper. Then again Australias public spending has been getting progressively less disciplined since the last major fiscal contraction in first half of the Howard Governments first term.

The first two policy suggestions argue for lower taxes. Australia has a lower tax burden than NZ – and that the gap has been larger in the past (though a reasonable proportion of the current difference represents NZs higher government surplus rather than higher spending).

The paper then claims that clearly New Zealands higher level of taxation will slow economic growth. To revert to the earlier analogy note how little hostile questioning this suspect receives in the witness box. I expect there are plenty of spending initiatives of the New Zealand government that I’d be happy to do without to secure somewhat lower taxation. But its actually hard to find strong econometric evidence that higher tax rates hurt growth. And given that, if a relationship does exist its likely to be a weak one and one thats unable to explain the difference in economic performance between the two countries.

There is evidence however that some kinds of tax reductions can be growth enhancing. Just not the ones the paper proposes! It proposes returning to a top marginal tax rate of 33% – reversing its increase to 39% a few years ago by the incoming Labour Government as its the first tax priority because it will have the strongest impact on growth.

Several things stand out about this proposal. Firstly there is no mention of corporate tax. There is in fact a strong correlation between countries rates of economic growth and their corporate tax rate. Here are the findings of Hassal and Mathur (2006) from a source that the CIS would find congenial. Our empirical results indicate that domestic corporate taxes are negatively and significantly related to wage rates across countries.

The same authors further conclusion is worth taking on board precisely because of the authors candidness in reporting it as contrary to their ideological priors. Our results for personal income taxes are surprising. We find that tax rates do not significantly impact wage rates..

Lee and Gordon (2005) likewise find a strong correlation between a countrys economic growth and its company tax rate – but virtually none between its economic growth and its top marginal tax rate.

So there you have it. Australia has performed much better since the 1980s with much higher top marginal tax rates but the top tax priority is to further lower New Zealands top marginal rate. Ideology to the rescue.

I guess it could have been worse. New Zealand might have compared its performance to that of a country of similar population size (though one in a very different location and economic circumstance). If theres one country thats clearly out-performed Australia during the relevant period, indeed one that has roughly doubled our per capita GDP growth its Ireland. Cutting corporate tax was the engine behind its extraordinary movement into a range of economic niches. Its corporate tax rate is 12.5%. Its top personal marginal rate? 42%!

VIII

Finally what to make of this new argument that New Zealand is suffering from stop start reform? As indicated above, I’m not sure that Australia hasnt suffered from something similar. Substantial reform was sporadic and infrequent under Howard with lots of improvised pork barrelling along the way.

But if there is something in the argument from whence might such a stop start tendency come? Phil Rennie, the papers author argues that Australia has a stronger political consensus around policies for growth which seems plausible. Here we enter a highly contestable and subjective realm about which people will differ, but I offer some impressions and observations for what theyre worth.

Though I have no idea from whence it might have sprung culturally, it has always struck me, to my surprise, that New Zealand politics and political debate more generally is both more ideological and more strident. The contrast between the Treasurers that launched reform in both countries is instructive. Both Australian Treasurer Paul Keating and New Zealands Finance Minister Roger Douglas were ambitious in the reform agendas they proposed and fought for. But Douglas was far more so.

I recall leafing through David Langes autobiography in a bookshop and reading of a meeting between himself and Roger Douglas. According to Lange, Douglas proposed reforms of such radicalism from memory not dissimilar to those later championed by ACT, the party he later founded that Lange was left wondering if he had flipped his political lid. The government ended in acrimony a year or so later. Douglas was famous also for proposing a reform style that in Australia is associated with Gough Whitlam – crash through or crash. It relied on reforming sufficiently comprehensively and quickly that it robbed its political enemies of time to mobilise. Clearly the unitary state and unicameral nature of the New Zealand Parliament made this more enticing because it was much more possible.

Other examples spring to mind. When one compares the New Zealand Business Roundtable with its Australian counterpart the Business Council there is a clear difference. I think the Roundtable is more principled in the stances it takes clearly something that can be a good thing. One might also argue that it is less pragmatic and flexible, and more ideological. I suspect that the Business Roundtable has not played the kind of role in consensus building for reform between labour and capital that the BCA participated in in the 1980s and early 1990s.

In Australia reform began with an accord between the ALP government and the union movement. Though it never formally included business, business was in fact drawn into negotiations with the official Accord partners. This process of involving social partners in the design of reform appears to have built a stronger constituency for reform as well as greater attention to political traps and to compensating those who might otherwise lose from reform.

My impression of New Zealand party politics is also consistent with the picture I am painting. In the last election in New Zealand there were strong differences in the economic strategies of the two major political groupings. On the reports I read at the time, the Nationals promised tax cuts of sufficient ambition that they would have very substantially reduced the surplus. Rightly or wrongly this reminded me of the Republicans in the US and their more or less overt strategy of taking whatever opportunity offers to reduce taxes in order to starve the best that is to cut taxes recklessly and so make smaller government an inevitable result.

By contrast for some time now, despite the inevitable jockeying for position, there has been broad bipartisanship on the stance of fiscal policy and much else besides. Indeed in the Australian election weve just had the Opposition base its own tax cut proposals on those offered by the then governing Coalition. The only difference was that the ALP proposed to shave tax cuts at the top of the income scale to enable the funding of other spending priorities.

IX

That brings me back to the paper under consideration. In identifying cutting the top marginal tax rate as the highest tax priority the paper described New Zealand Labours move back towards a more Australian schedule of tax progressivity its increase of the top marginal rate of tax from 33% to 39% as symbolic, destructive, and completely unnecessary. So many adjectives!

In my judgement it wasn’t particularly economically destructive, though I would agree with raising the threshold at which the top rate cuts in as a worthwhile priority. Beyond that, if I were cutting taxes, as Ive intimated above, I could think of much better places to cut them I’d start with company tax. However my first tax priority would be introduce a capital gains tax I think New Zealand is the last Western democracy without one and to recirculate the revenue raised with tax cuts. But we get no mention of this levelling of the playing field in the paper.

But what of that other adjective symbolic? I have little doubt that, though it was economically defensible it raised a substantial amount of revenue in some measure the tax increase was symbolic. Politics is like that. I guess cutting it to 33% was equally symbolic. Isnt it the essence of a more conciliatory approach to political debate one thats more likely to build a broad constituency for reform that one respects the symbols of the other side of the debate, at least when theyve won adherence to them in the crucible of democratic politics?

Mightnt it be more conducive to productive debate to let the winning side have its victory for a while and to seek to engage it on matters that might be of similar (I would argue much greater) import rather than hopping into the trenches and – to mix a metaphor – simply upping the symbolic ante? At least for a time? I suspect, I hope that thats what wed do in Australia.

Of course in doing this the new ALP Government is guided by its sense of its own political interests. But then thats all part of building a deeper constituency for reform. I’m hoping that the new Australian government wont be trying to settle ideological scores or scores of any kind, but that it will husband its energies to focus on the fundamentals of good policy as well as forging new reform paths like its done in the past with HECS and like the New Zealanders have done with KiwiSaver.

I’m aware that this is just a personal wish of mine – no more than a fancy. But I’m also thinking that, as the government rides the political roller coaster and prays for sufficient good luck to survive, the path I’ve proposed is also the greatest contribution it can make to its own long term survival. I’m hoping it will be keeping its powder dry for the gradual unfolding of reforms that make a major contribution to the prosperity and quality of our lives.

References

Hassett, K.A. and Mathur, A. 2006, Taxes and Wages, American Enterprise Institute, AEI Working Paper No. 128, June, 2006

OECD, New Zealand should strengthen its policies to foster innovation, says OECD, statement on release of OECD, 2007, New Zealand – OECD Review of Innovation Policy, available at http://www.oecd.org/document/5/0,3343,en_33873108_33873658_39148805_1_1_1_1,00.html

Lee, Y., and Gordon, R.H. 2005, Tax Structure and Economic Growth. Journal of Public Economics Vol. 89: 1027-1043.

Ambler, Tim and Chittenden, Francis, 2007. Deregulation or Déjà Vu?, UK Deregulation Initiatives 1987/2006, A report published by the British Chambers of Commerce accessed on 15th February at http://www.chamberonline.co.uk/policy/pdf/deregulation_report_2007.pdf

Nicholas – excellent article. I’ve been looking at NZ for a number of years now and have a couple of other thoughts you might consider (that complement, don’t run counter to, your article).

first, a measurement problem: the large and increasing percentage of economic activity that takes place via the marae is not measured in standard national accounts. this is because it is largely barter based and in many cases includes goods not normally traded in any case (ie much activity with with cultural rather than monetary value). the deep influence in NZ of Maori – and also incrreasingly Pasifika – culture is a striking difference to Australian experience. there’s New Zealand researchers who’ve been looking at economic ramifications of whanaungautanga relationships but I’d doubt CIS would have. In other words, NZ might not be as badly off as the official statistics suggest.

second, the continuing importance of agriculture. In NZ it has dropped as a percentage of GDP, just like Australia, but is still around 6% compared with our 3% – and also something that is still considered a core part of economic policy. I’m also struck by how much unproductive effort New Zealanders put into small scale, uneconomic agriculture – eg leading business people who feel a need to establish their New Zealandness by owning a small farm with a couple of hundred head of sheep. also happens in Australia, but to a lesser extent

third, the disadvantages of size and location are worth stressing more; its hard to agree with the CIS conclusion that these ought not to make a difference to the relative standing of the two countries. Ignores the cost and risk equations involved. Example: if I’m a large firm interested in investing in a distant market, but have limited resources, do I put those resources into researching the opportunities in a country of 20m people or 4m? As domestic capital reaches its limits (in either country) then reliance on international capital comes to be more important over time, and clearly leads to different trajectories for large v small. Location also very important: need to be careful in comparisons with Ireland, which has the advantage of at least being between europe and the US (whereas NZ is an end point rather than a stop on the way to anywhere).

Nicholas (and Phil) – have just noticed your exchange in the earlier post via the “latest comments” sidebar; and see Nick has also pointed out that small size may be coming relatively more important. Phil, from your posts I’d guess you have looked at a number of these, but had run out of room to include them all – would be interested to see your comments about why culture does not make a difference (contra to my suggestion above that it does).

Hi Stephen, at the risk of giving Nicholas yet more ammo, I’ve published an article about possible cultural differences in the CIS’s Policy magazine this week – available here.

As the article says, underachievement amongst Maori and PI alone can’t explain the gap with Australia. Also I’d dispute that farmers are unproductive, I don’t have the stats off hand but I think agriculture has been one of the most productive sectors since subsidies, tariffs etc were removed.

Will attempt a longer reply tomorrow

cheerio

Phil,

the link is very poor ammo – it doesn’t work ;)

Actually – have just figured out the problem – a rogue full stop in the hyperlink. Will fix.

would not claim NZ agriculture is unproductive – far from it, there have been strong productivity gains in that sector; the point was not about those whose full time job is being farmers, but an observation that there is a strikingly high amount of the time of business execs (who in other countries concentrate on growing their own businesses) being put into small scale agriculture.

Nicholas, leaving aside the ideological argy-bargy, I think it’s possible to take a macroeconomic view of the question that suggests differing patterns of GDP per capita growth between Australia and New Zealand have little to do with differences in micro-economic policy, and a lot to do with different economic starting points, or endowments, and macro-economic factors.

Phil’s GDP per capita chart shows very clearly where NZ fell behind Australia: in the late 1980s NZ flattens out relative to Australia then declines into the early 1990s, then falters again around 1998.

These occasions coincide with NZ experiencing:

a) an earlier and much more severe recession in the early 1990s than Australia; and

b) NZ experiencing an export-led recession in the wake of the Asia crisis in 1998, when Australia did not. This coincided with a drought affecting agriculture – a much larger sector in NZ than Australia, with a much greater share of exports.

The relative GDP growth rates are seen pretty clearly in this chart

Relative underperformance through these two periods explains the bulk of NZ’s GDP per capita gap with Australia, and can be attributed largely to the RBNZ’s highly restrictive monetary policy around 1990 in the face of chronic high inflation and the vulnerability of NZ exports to the Asian crisis and weather during the late 1990s.

Incidentally, I found Phil’s commentary on NZ’s trade position vis-a-vis Australia particularly scant and underwhelming. The NZ economy is much more exposed to trade than Australia, with exports dominated by weather-dependent agriculture (dairy and meat) and the forestry sector. Also, the terms of trade improvement for Australia over the last two decades far surpasses that of NZ due to our greater reliance upon non-rural commodities (i.e. metals, coal) which have surged in price in the last few years in particular. However, while you’re right in noting that the bulk of that outperformance has occurred in the last five years, Australia’s terms of trade outperformed that of NZ through the late 1990s also.

While I don’t think trade is the only (or even major) explanator behind the difference in GDP per capita, it’s not tenable to argue that different patterns of trade (and thus trade endowments) aren’t a contributing factor.

P.S. Nicholas, given your other interests, I think it’s instructive that New Zealanders have such a strong preference for fixed rate mortgages over variable rate. It’s often suggested that greater interest rate volatility – and thus macroeconomic volatility – in NZ explains a large part of this preference.

Thx Fyodor,

The greater interest NZers have in fixed rates is interesting and perhaps corroborating evidence that they’re more risk averse as Phil suggests in his next piece of work – linked to above – which is full of interesting stuff for anyone who wants to check it out.

And yes, the other explanation, which I should certainly have listed is the macro-economic one – I do think it’s an important aspect of the story – particularly the second time around. I would tie that into my critique of the more polarised nature of NZ institutions. At the time of the late 1990s downturn the RBNZ was led by a pretty ideological fellow – who went on to lead the Nationals. And though the RBNZ had led the world on inflation targeting, it was (or the methodology it was using to set rates was) particularly hawkish about inflation going into the Asian crisis when wiser heads in Australia and the US were concerned about deflation.

Oh – and ‘part three’ as it existed in draft form on the server actually begins with the graph you’ve directed us to Fyodor.

Hugh Paveletich emailed me the following comment and asked me to post it for him.

As Dani Rodrik notes in this post asking firms what constrains them might give misleading impressions. I expect that’s the case for NZ firms and capital – though it is true that more recently their relative cost of some debt capital has not been as expensive as it was a few years ago.

I agree that personal tax rates get way too much air time. Of course there is a certain point at which people start trying to avoid them, but neither Aus or NZ are near that point so it is a bit of an ideological furphy…

What I wonder about is not just the differences in scale and size of the population in the respective countries, but also the real rate of urbanisation. If we discount any urban agglomeration with less than 300k people, this leaves NZ with an urbanisation rate of 50%, if urbanisation is defined by the percentage of people live in actual cities. The same goes for both countries, whose official urbanisation rates are, I think, not really relevant to discussions of international competitiveness and economic development. It’s all very well for Nowra and Dunedin to call themselves ‘cities’, but there is not a lot that a regional town of 40k people, or even 100k, can do to add to the productivity of the nation except by allowing government services to be delivered more efficiently.

By the same measure, Australia has 70% of its population living in largish cities. This difference is significant and I wonder what you think about how that would influence the difference between the two countries.

Note: A city is a place where labour markets are at their most flexible and efficient, where surplus labour can be matched with capital where it is needed at the right time. Someone in a town of 30k people cannot commute outside that region really, and so is only available to those small industries in that town. Equally, companies need to be in proximity to other companies which can’t happen when there is only one, two, or three relevant companies in a region. The above choice of 300k as a floor for defining a ‘city’ really might be quite generous, and it may be that NZ really only has a quarter of its population living in places where they can be involved in really innovative and productive economic activity. The exception is agriculture but of course we know that the labour force required for that is very small, which leaves a lot of low-paid labourers, cafe waitresses and check out chaps.